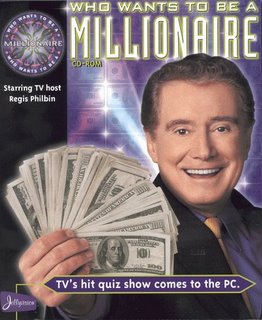

No such thing as free money...

So I borrowed $20,000+ on two credit cards at 0% for one year. That's $4,000+ borrowed about 8 months ago and $16,000+ borrowed 2 months ago. I am leaving that money at HSBC Direct (4.75% APY until April 30th). I expect to make at least $800 dollars of interest on that money before paying it back.

Here comes the not so free part -- your credit score takes a hit. As a result of the $16k CC debt, my FICO score dropped from 741 to 718. Of course I knew that my credit score would suffer because 35% of credit scoring is dependent on debt load. The good news is that the 23 point drop is less than what I expected. I will be fine as long as my FICO score is more than 700.

In conclusion, free money - good, lower credit score - bad, one more bill to pay every month - bad. Like everything else in life, it's a choice you have to make.